Measure 108: Tax raise on Tobacco and E-cigarettes

November 2, 2020

This measure will increase the tax on tobacco products. The tax money will go to the state’s Medical Assistance Program and other health-related programs. Cigarette tax will cost $3.33 instead of $1.33.

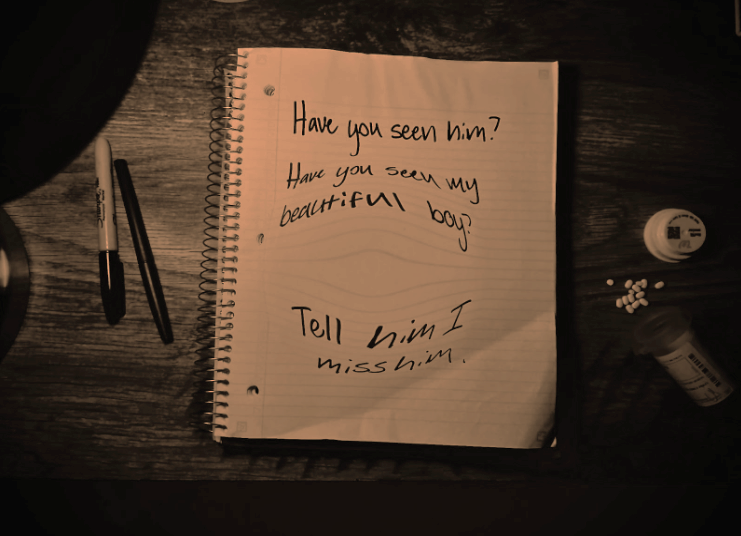

Smoking is the number one leading cause of preventable death in Oregon. With the rise of teens using e-cigarettes and vapes, the chances of teens becoming more addicted will become higher and so will the death rates.

If you vote no, that means that the cigarette tax will stay the same. The argument supporting voting no explains that taxes are an unreliable source of revenue. Oftentimes, when the sale price increases, the sales tend to decrease then, affects the tax revenue. This will also affect the small businesses that are already struggling during this pandemic.

If you vote yes, the tax rate will increase and occur in January of 2021. Many healthcare providers support this measure such as Kaiser Permanente, Providence, and many more. The goal of this measure is to lower the number of people who smoke and hope to decrease the rate of people who die by smoking.

Sources:

OPBWeb. (2020, October 15). Oregon Measure 108 explained. Retrieved November 03, 2020, from https://www.youtube.com/watch?v=rfH0fxB_Tx4

Oregon Measure 108, Tobacco and E-Cigarette Tax Increase for Health Programs Measure (2020). (n.d.). Retrieved November 03, 2020, from https://ballotpedia.org/Oregon_Measure_108,_Tobacco_and_E-Cigarette_Tax_Increase_for_Health_Programs_Measure_(2020)